Instructions to possess Function 1040 2024 Irs

I n s t r u c t i o n s t o p o s s e s s F u n c t i o n 1 0 4 0 2 0 2 4 I r s

Content

- Worksheet, Range 1, Requests At the mercy of Play with Income tax

- National average interest rates for Dvds

- Stating refund otherwise repayments produced for the a distinctive get back whenever amending their income tax come back:

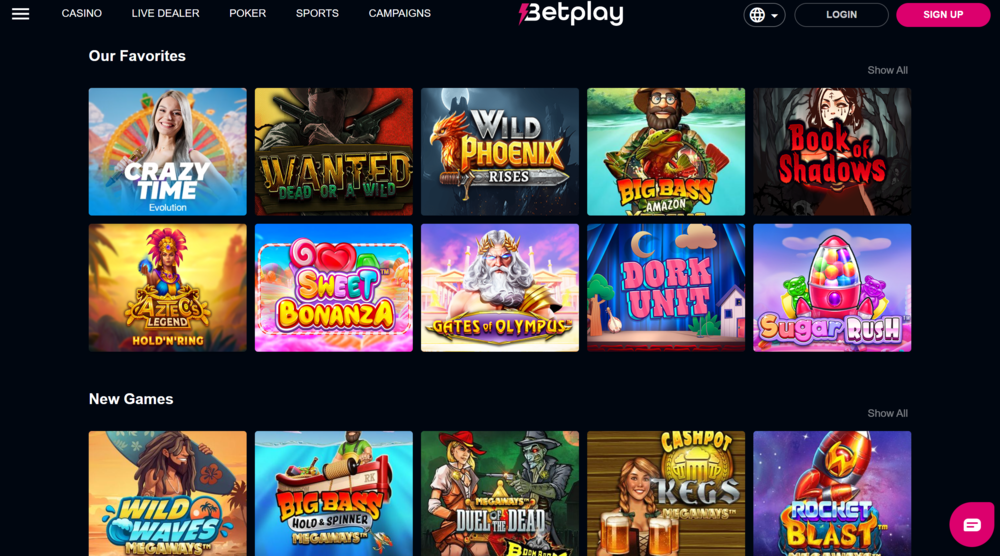

- Perform down deposit online casinos render position video game?

- What exactly are casino no-deposit incentives?

Alternatively, play with single, married/RDP filing separately, otherwise being qualified surviving partner/RDP submitting condition, any relates to your. For many who registered an amended get back to your Irs on this issue, you’ve got two years in order to file your own amended Ca return. No-rates or Reduced-rates Healthcare Publicity Suggestions – To own nonexempt years delivery to your or after January 1, 2023, we extra another healthcare visibility information concern on the taxation get back. If you are trying to find zero-prices or lower-cost medical care exposure suggestions, browse the “Yes” field for the Form 540NR, Front side 5. Come across particular line instructions to own Mode 540NR, Health care Coverage Suggestions area. Married/RDP Submitting Together in order to Married/RDP Processing Separately – You simply can’t go from married/RDP filing as one so you can married/RDP filing separately following the due date of one’s income tax return.

The current you to-half of addition rate in addition to applies to financing loss. It financial, as its name indicates, is one of the basic on the internet financial institutions, established in 1999. Their full name try First Web sites Lender of Indiana, though the financial works nationwide. The financial institution’s Computer game cost were consistently competitive to own quick and much time Video game terms.

- In addition to get into “Repaid” plus the count you repaid for the dotted range near to line 7.

- Announcements from an excellent kid’s dying are wanted to the fresh CRA from the provincial/territorial important analytics companies.

- The application form allowing for their refund becoming deposited to your TreasuryDirect membership to shop for deals ties, and the power to pick paper bonds with your refund, could have been left behind.

- To your Internal revenue service.gov, you can buy up-to-time information about most recent incidents and you may alterations in income tax laws.

- For many who generated energy conserving developments to a single or maybe more belongings which you utilized because the a home during the 2024, you might be in a position to take the domestic clean energy borrowing.

Never document Mode 8862 for many who recorded Form 8862 to possess 2023 and the boy taxation borrowing from the bank, more kid tax credit, otherwise credit with other dependents are invited for this seasons. This needs to be revealed in the field 4 out of Function 1099, package 6 from Form SSA-1099, or box ten of Function RRB-1099. Don’t document Mode 8862 if you registered Mode 8862 to own 2023, and the kid taxation credit, more son taxation credit, otherwise credit to many other dependents try acceptance for that season. The brand new superior will likely be to own publicity to you, your lady, otherwise dependents.

Worksheet, Range 1, Requests At the mercy of Play with Income tax

To make a little put at the a new casino lets somebody to have program as opposed to risking a great good deal out of currency. Professionals can see just what casino now offers, for instance the group of games, ads, and you can system. Taxpayers have the to expect the brand new income tax program to take on items and issues that may affect the hidden obligations, capability to shell out, or ability to provide guidance prompt. Taxpayers feel the directly to found assistance from the fresh Taxpayer Endorse Services if they’re feeling financial challenge or if perhaps the newest Internal revenue service hasn’t fixed its tax things safely and you may fast making use of their typical streams. Taxpayers feel the to predict you to definitely any advice they give on the Irs will never be disclosed except if authorized by the taxpayer or by-law.

See TreasuryDirect.gov/Research-Center/FAQ-IRS-Tax-Feature. For individuals who obtained digital assets as the typical income, and therefore income isn’t said somewhere else on your get back, you are going to enter into those people numbers to the Schedule 1, line 8v. For individuals who are obligated to pay choice lowest income tax (AMT) or should make a surplus get better superior income tax credit cost.

All of our point would be to emphasize banking institutions somebody nationwide is also explore, but we wear’t showcase profile one to impose large equilibrium minimums in order to either unlock or take care of an account. Minimum deposit criteria away from ten,100000 or higher influenced results adversely, while the did large minimal harmony standards to quit costs. Possibly not surprisingly, the major issue is large rates of interest. I used the fresh questionnaire’s brings about create the methodology i use to rate numerous out of offers account.

National average interest rates for Dvds

You can either happy-gambler.com official website afford the superior yourself otherwise your connection is also pay them and declaration them since the guaranteed money. If your coverage is within their label and you also pay the premiums yourself, the relationship need to refund both you and declaration the fresh premium as the protected costs. Qualified expenses tend to be number paid or sustained inside the 2024 for personal protective gizmos, disinfectant, and other provides employed for the new avoidance of one’s pass on away from coronavirus. Go into the level of their overseas earned money and you will housing exclusion of Function 2555, line forty five.

Would be to a great provincial or territorial Crown firm claiming the fresh income tax borrowing from the bank not report annually about precisely how the new tax borrowing from the bank provides improved ratepayers’ expenses, a punishment would be energized compared to that Top corporation. But not, numerous income tax loans might possibly be readily available for the same venture, for the the quantity that endeavor boasts expenses entitled to other income tax credits. The brand new Clean Strength financing tax borrowing might possibly be susceptible to prospective installment personal debt just as the recapture laws and regulations recommended for the Clean Tech funding tax borrowing. Within the newest laws and regulations definitely features discussed within the Class 43.step 1 or 43.dos, all of the requirements to have addition in the Group must be met to the an annual basis. You will find a small exemption regarding the Income tax Laws and regulations for assets that is element of a qualified system which was in the past run within the a being qualified trend.

Matthew is actually an elder consumer financial reporter with more than two ages from news media and monetary services systems, helping customers generate informed behavior regarding their private money demands. Their banking profession comes with are an excellent banker within the Nyc and you can a financial manager from the among the nation’s premier financial institutions. Matthew is a member of one’s Panel from Governors during the the newest Neighborhood to own Going forward Business Editing and you will Creating (SABEW), chairing its education member engagement committee which can be co-sofa of the Financing Panel. That is a destination-affect membership available at both banks and borrowing unions that’s like a savings account and also offers specific family savings provides. All of us of benefits features checked out of a lot 5 minimal put Australian casinos to provide its miracle provides. Learn more, and we will help you make the leader to the membership of your own new looking the whole set of advice you’re also looking.

Stating refund otherwise repayments produced for the a distinctive get back whenever amending their income tax come back:

Which have an internet account, you have access to many suggestions in order to during the the new processing year. You can get an excellent transcript, remark their lately registered tax go back, and now have the adjusted revenues. Generally, to quick claim a reimbursement in your amended come back, Setting 1040-X have to be registered within this 36 months after the go out the newest unique return is registered otherwise inside couple of years following the time the brand new taxation is actually paid off, any type of is after. Nevertheless have more time so you can file Function 1040-X if you reside within the an excellent federally stated disaster city or you are personally otherwise psychologically incapable of manage your economic items. Inability to provide an granted Ip PIN to the digital get back will result in an incorrect trademark and a declined go back.

Perform down deposit online casinos render position video game?

RDPs, use your recalculated government AGI to figure the itemized deductions. For those who have a foreign target, proceed with the nation’s behavior to have entering the urban area, county, state, county, country, and postal code, since the appropriate, regarding the compatible boxes. To find out more, visit ftb.california.gov and appearance to possess revelation duty.

Fully taxable retirement benefits and you may annuities likewise incorporate army senior years spend found on the Mode 1099-Roentgen. You might have to shell out an additional taxation for those who obtained a young delivery out of your IRA and the total was not rolling over. See the tips to own Agenda dos, range 8, to have info. Desire paid in the 2024 for the places which you failed to withdraw while the of one’s bankruptcy otherwise insolvency of your standard bank will most likely not should be found in their 2024 money.

What exactly are casino no-deposit incentives?

If you meet with the modified revenues specifications, you’re able to utilize 100 percent free income tax preparation software to help you prepare and you can age-file your own tax return. Check out Irs.gov/FreeFile to find out if your meet the requirements as well as for considerably more details, as well as a summary of 100 percent free File leading people. For many who obtained nontaxable Medicaid waiver costs, those number will be now getting claimed for you for the Mode(s) W-dos in the package 12, Password II.

Katerina Monroe

@katerinam • More Posts by Katerina

Congratulations on the award, it's well deserved! You guys definitely know what you're doing. Looking forward to my next visit to the winery!